Social media is the biggest buzz word which has emerged from the second half of the first decade of the 21st century.

It has made its presence felt in our day to day activity more than any other single product which has found acceptance in the society. It has re defined the way we communicate, do business, and pass our leisure time among many other things. But still, many believe that social media can help us in more ways then we can imagine, and what we are witnessing is just the tip of the ice berg among the many benefits which social media has to offer us.

In this context, I always felt that social media can in fact help us tackle the volatility of the most unpredictable yet the market with highest number of transactions: The Stock Market.

Stock Market is been in existence for more then two and a half centuries. It has created many millionaires from ordinary men and has also made many millionaires into a pauper. Yes there are many technical explanations as to why stock market go

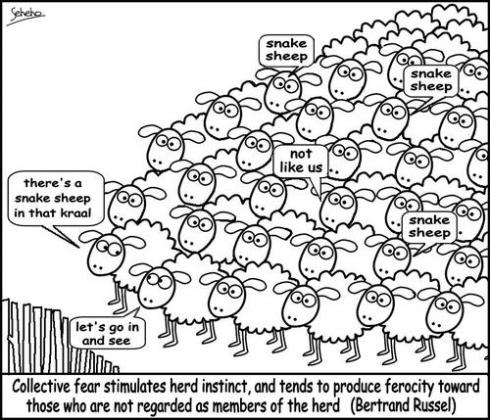

es up and down but at root; it’s all about herd psychology. When stocks are going up even the experienced investor succumbs to what former chairman of American Federal Reserve Allan Greenspan called: the irrational exuberance. And when wind changes direction even slightly the mood quickly changes from euphoria to gloom. This irrational exuberance was first created by Missisippi Bubble which destroyed the French economy in 1719 for over a century and also led to infamous French Revolution. It was the first stock market crash in the history of mankind. This was followed by 1873 depression of railroads, the Great Depression of 1929 and more recently the property bubble of 2008 and the Euro Crisis of 2012.

Stock market for almost 3 centuries has witnessed these massive tectonic ups and downs not because of the actual performance of the companies in which the investors were investing. But what the investors thought how the companies are performing. And infamous companies like Enron and back home Satyam made its investor believed that they are performing well and this help augment their share price but once investor comes to know about the reality its share price came crashing down. These are few examples of companies using these herd psychology to its advantage.

Unfortunately, some honest performing companies are affected adversely by this herd psychology as well. There was a time when even the news of Warren Baffet investing in some companies augments its share price by up to 10%. When ever people see some big investor has sold the stocks of a particular company thousands of small investors follow suit without knowing as to why he sold the shares resulting in a massive decline in share price. May be he is selling those shares in order to buy it again at half its price.

What if there is group for all the investors of a particular company in say Linkedin. If you are a shareholder in a company you would be the member of that group. Any investor planning to sell his/her shares needs to inform the other group members its reason. There could be a discussion thread with other investors. The investor will know whether the company is actually performing badly or he/ she is withdrawing his/her investment for some other reason. This will result in investor making more informed decision and will reduce the influence of so called herd psychology to a considerable affect.

This sharing of knowledge can be done in the following ways:

- All the listed companies should have a group for its investor in Linkedin

- A person who wants to invest in any company can becomes its member

- He can see the discussion of other investors and from there he can identify as to why these buying and selling is happening

- When he wants to sell the shares he can post his reason if it is personal it is ok, but if he has made a business decision the other investors can join in and comment their views

- There would be some who purposely wants the share price to go down and might post some negative comments

- This can be done by relying on wisdom of crowd because the current investors would never want their share price to go down so they would be aggressively defending it.

The only de merit I can see from this is the volume will go down and the brokers would be the worst hit of them all.

I finally have to say that the volatility of stock market can be reduced only if we reduced the influence of herd psychology this can be reduced if the investors know why the other investor knows why he/ she sold his/her shares. This information needs to be shared at real time and social media with its ubiquitous presence is perhaps the only medium by which the information can be shared to such a large and spread out group of people.

Happy Investing